Hotel market customer segmentation

Powerful value-behavioural segmentation for Whitbread’s Premier Inn

Powerful value-behavioural segmentation for Whitbread’s Premier Inn

The brief

Whitbread is a large UK hospitality business with major lines of business in coffee shops with Costa Coffee, in hotels with Premier Inn and in restaurants with Beefeater, Table-Table & Brewers Fayre restaurant brands.

Premier Inn is the UK’s largest hotel brand with over 650 sites throughout the country. Growing fast and with millions of hotel nights being sold, Premier Inn needed to understand more about the hotel customers staying with them.

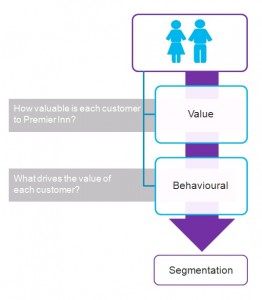

With differences between when, where and how often customers stayed, as well as differences in when they booked and what price they paid, Premier Inn needed to explain differences in behaviour and to know whether business performance could improve through clustering customers with similar needs and behaviours together into natural segments, to be able to treat different segments in different ways.

Strategy

Working closely with a technically capable data processing and analysis specialist, we proposed the design and build of an actionable Customer Segmentation with which Whitbread & Premier Inn could understand, manage and engage with customers by segment. Just as importantly we chose to emphasise the role of a carefully thought through roadmap for implementing the segmentation across the business.

Actions

Data gathering – to start with we needed to gather the right inputs – customer data held in different operating systems run in different parts of the business. Including the main hotel bookings system, but also drawing on data from other operating systems for web bookings, for account card data, for corporate account data – all combining to form a ‘single view of the customer’.

Single customer view (‘SCV’) – in total, data for over 18 million nights stayed in Premier Inn hotels came together drawing on 11 million records, across 5.5 million individual customers. Busiest days at Premier Inns are midweek for business and weekends for leisure stayers. So splitting business from leisure was an obvious starting point.

Pareto principle – early findings showed a clear pareto factor, overall and within both types of stayers. Business stayers were more valuable generally spending, on average, nearly three times as much per year as the average leisure stayer. Within both business stayers or amongst leisure stayers, the top spending 20% of either type of customer accounted for a far higher proportion of revenue. So some customers are more valuable than others. But why? Finding the factors driving the differences in value might lead us to an answer to our question of how to group customers together into an actionable segmentation.

Customer segmentations – the power of putting the data together showed us correlations to propose the key characteristics describing different segments. We built two segmentations, one for business and one for leisure. They had four key variables in common including price sensitivity, how far in advance of a hotel stay they booked, where they stayed and in how many different hotels, and whether they bought add on products and services.

Then for leisure how engaged they were with Premier Inn as a brand was an extra leisure-specific segment characteristic; whereas for business, how much control they had over their booking was an extra business specific segment characteristic.

Results

Both segmentations changed how Premier Inn operated in terms of planning around an understanding of customers – treating different segments in different ways according to the differences between them.

- For example with average spend per customer per year by segment ranging from £100 to over £1,500 for business versus £50 to £180 for leisure stayers, their value and purchase frequency became central to planning promotion to them as segments

- As a second example the segmentations drove planning in the promotion of rooms for those segments who book ahead, paying less using ‘early bird’ offers, versus those who book late with ‘last chance’ offers, happy to pay more

These two changes alone contributed to growing the effectiveness and efficiency of customer relationship management at Premier Inn. With +70% year-on-year tracked revenue growth for 18 consecutive months, targeted promotional messaging delivered growth of over +£70m in revenues for the business over the period, with the segmentation work playing a major part in this success.

Click here to browse through a variety of marketing case studies by sector, by category or for new, recently added case studies.